The electrical power sector landscape was shaped in recent years by the European Union's energy policy and focus on the transition to a decarbonised energy system. Renewable generation has grown significantly in the past decades, and this steady growth will continue in the coming years.

Large-scale fossil-fuelled power plants are being phased-out, while variable renewable energy systems (vRES), especially solar and wind technologies, are continuously increasing their shares in the supply mix. In addition, flexible storage resources (e.g. electric vehicles, batteries or heat pumps) are being deployed and an increasing number of end users are changing from passive consumers into prosumers.

At present, it is still unclear if current electricity markets design, which is based largely on marginal costs pricing, will be able to evolve into a form adequate to embed the impact of the rising penetrations of vRES. However, it is already clear that the current design does not favour their fair participation unconditionally, due to the inherent fluctuation nature of vRES generation. The need of R&D assisting to adapt the current electricity market rules to a new trading and power system’s paradigm is widely recognized these days.

That was the context in which project TradeRES – Tools For The Design And Modelling Of New Markets And Negotiation Mechanisms For A ~100% Renewable European Power System (H2020 contract 864276) was conceived, having as goals to: i) Identify actual barriers and deficiencies of current energy market and pricing structures; ii) Calculate cost, value, and price structure of electricity in a ~100% vRESdominated electricity system for 2030 and beyond; iii) Conceive, design and model electricity markets that deal with novel flexibility products; iv) Develop optimization and agentbased market models beyond the state-of-the-art.

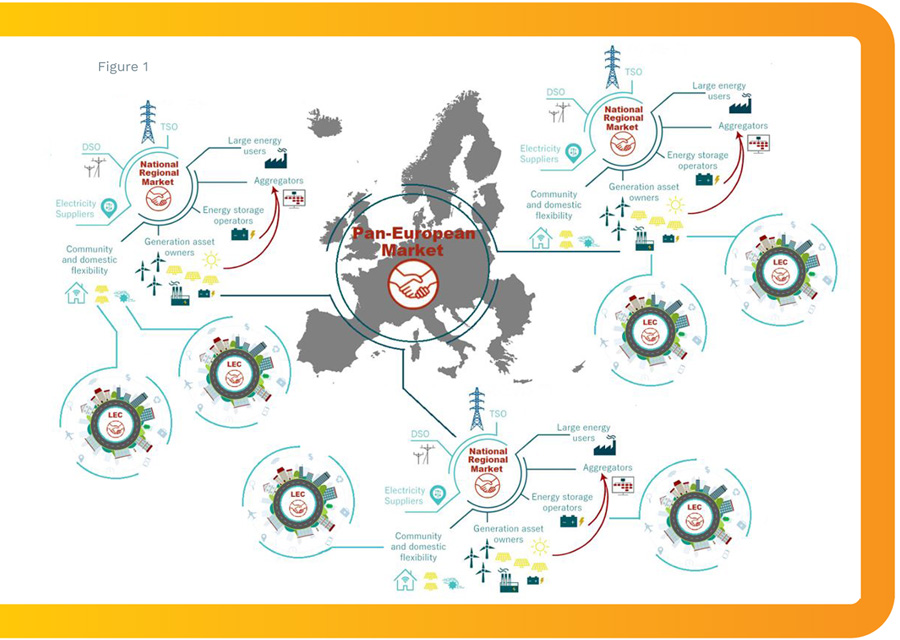

To achieve these ambitious goals, existing agent-based market models are being further improved with new features and coupling worksflows, and also new models are being developed, that are applied to five different case studies ranging from local communities and markets (Case Study A) to the European market (Case Study E), passing through the national and regional scales (B – The Netherlands, C- Germany and DIberia/ MIBEL), as depicted in Fig. 1.

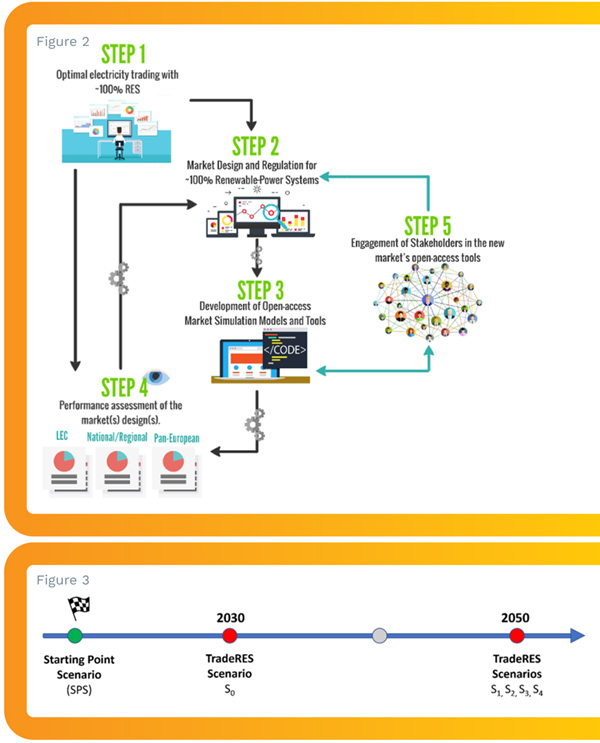

The TradeRES project was conceived with an iterative methodology (Fig. 2), in which the newly developed designs and products are tested by market stakeholders. The second iteration of the studies will apply a new improved version of the market functionalities reflecting the inputs and suggestions received from the stakeholders.

TradeRES' research questions, scenarios and Market Performance Indicators for ~100% RES Power Systems

TradeRES' research questions, scenarios and Market Performance Indicators for ~100% RES Power Systems

A deep and detailed exercise was conducted to clearly identify the relevant research questions (RQs) to be addressed by the project, cluster them within classes, as well as to associate them to the capabilities of different models and markets characteristics. Seven different classes of RQs were identified: 1) Improvement of energy-only (EOM) short-term markets; 2) system design and adequacy; 3) ancillary services in ~100% power systems; 4) investment incentives for vRES and 5) for secure capacities (EOM or capacity mechanisms); 6) Incentivizing distributed flexibility and local markets and 7) Incentivizing demand response and sector coupling.

A set of scenarios were developed based on optimization models and those were recently simulated for national and regional markets: These include, e.g. scenario S0 to capture key milestones of the energy transition process which is planned to occur by the year 2030. The expected transition until 2050 (when climate-neutrality is to be reached) is addressed through S1-S4 TradeRES Scenarios. These are identified as the "Conservative" (S1), "Flexible" (S2), "Variable" (S3) and the "Radical" (S4) scenarios. The timeline in Fig. 3 positions the scenarios to the key milestone years and also indicates the Starting Point Scenario (SPS) that refers to a historic recent year with stable market and power system performance (i.e., 2019, recently simulated) [see Deliverable 5.3].

The Local, National and Regional European Markets

Although it is not within TradeRES work programme to address the actual volatility of electricity markets, mainly induced by external factors, the recent events further enhanced the need to electricity markets and carefully identify their vulnerabilities, to design new features that are more robust and present a lower level of risk for all the players involved. In that context, it is of particular relevance to study the future evolution of existing electricity markets in Europe, what TradeRES recently successfully concluded.

The National and Regional European Markets accomplished the set of simulations by addressing the following aspects: Case Study B – the behaviour of the Dutch electricity market using the soft-linked market models AMIRIS-EMLabpy aiming to analyse both if an energy-only market will be sufficient to achieve the Netherlands' vRES target for 2050 and to analyse if such a system can ensure security of supply. Case study C addressed the German dayahead market using the agent-based model AMIRIS to analyse the need and possible design of remuneration schemes for vRES; Case study D addressed the Iberian market (MIBEL) with the agent-based models MASCEM and RESTrade to analyse new market features able to mitigate the impact of vRES variability and uncertainty in the market revenues of those power plants.

Given the parameterisation of the SPS (including a moderate CO2 and commodity price level), for the remuneration schemes examined (an EOM without support, a fixed market premium, a variable market premium, a two-sided Contracts for Differences scheme and a capacity premium), not much difference is observed in terms of most market performance indicators (MPIs) studied. This holds for a system with a moderate RES share (34%) and relatively low average price levels compared to the current high price situation. Given such a price levels it was also found that renewables would not be able to recover their full costs on a pure market basis. The parameterizations assumed in the Iberian case study (D) revealed different market outcomes for Portugal and Spain. E.g., when levelized remuneration supports (the same as described for the German case study) were applied to both countries for the SPS scenario, in Portugal only the two-way contract for differences (CfDs) scheme does not enable players to obtain remunerations above the variable premium, used as reference, whereas in Spain, in what concerns wind energy, none of the support schemes allowed wind investors recovering their (annualised) investment costs.

Economic Benefits of P2P Energy Trading Paradigm

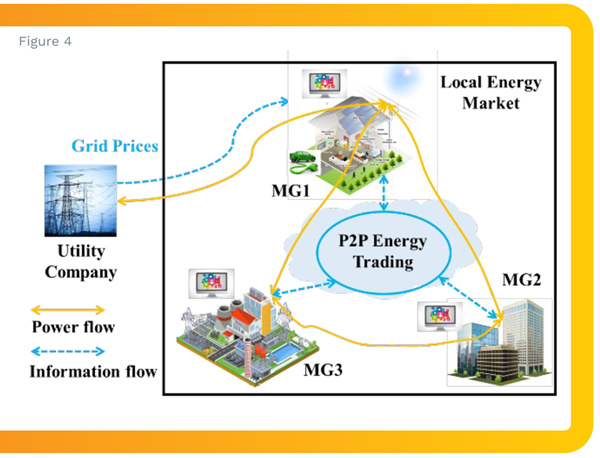

Based on the trading paradigm shown in Fig. 4, within TradeRES a peer-to-peer (P2P) trading platform is coordinating energy trading (quantities and prices) among three microgrids (MGs), independent of the upstream utility company. MGs in the P2P trading platform can buy/sell their energy deficiency/surplus with each other at local prices rather than trading with the utility companies at the offered grid prices, e.g., Timeof- Use (ToU) tariff and Feed-in Tariff (FiT). More specifically, a MG with an energy deficit can take advantage of other MGs with an energy surplus by purchasing their excess at a lower local price in comparison to the grid's ToU tariff. On the other hand, a MG with excess energy can make more revenue compared to the unattractive grid FiT by participating in P2P trading. In this context, MGs can first share their energy demand and generation internally within an energy cooperation concept and settle the remaining energy deficit or surplus with the utility company. It is expected that the local trading prices obtained are within the range of grid prices (i.e., FiT and ToU), so that the buyers and sellers within the MGs can achieve more trading deals and costeffective performance locally. Overall, the benefit of P2P energy trading lies in balancing local demand-supply, utilizing local renewables, reducing energy costs and managing local network congestions. The TradeRES project will also evaluate the above P2P energy trading paradigm and assess the role and value of the Local Energy Markets (LEM) in supporting cost effective transition to zero carbon electricity system.

Final notes

All the first simulations applied to national and regional markets are preliminary and it is too soon to extract final conclusions or recommendations for suitable market designs. However, the MPIs obtained so far for SPS scenario (2019), point out energy-only markets seem to be insufficient to give enough incentives to promote investment in a high volume of renewables. For the German case study, this holds for all kinds of RES that showed market-based cost recovery rates below 100% (slightly above 70% for PV, roughly 50% for onshore wind and 34% for offshore wind), which are also affected by the relatively low price levels of the considered scenario. An exception exists, as PV systems in the Iberian electricity market (MIBEL) were found to be profitable on an EOM basis.

The 2019 simulations of MIBEL and the Portuguese and Spanish ancillary services and imbalance settlements enabled to calibrate the MASCEM and RESTrade models to obtain close-to real-world results. For the second iteration of these markets, S1-S4 scenarios will be addressed, assessing the impact of temporal and sectoral flexibilities and the performance of new market design bundles for RES-dominated scenarios. In what concerns ancillary services markets, the Portuguese and Spanish control zones have different rules for vRES market players. In future scenarios, the participation of vRES and demand players in these markets will be addressed for both countries.

Finally, the studies conducted enable to observe a P2P energy trading paradigm contributing to the efficient management of energy supply and demand by promoting direct energy exchange within a local energy market, which would provide significant economic benefits, compared to a conventional retail market.

Readers may find more information about TradeRES project at the link https://traderes.eu/ including the large majority of the deliverables, of public access.

This work has received funding from the EU Horizon 2020 research and innovation program under TradeRES project (grant agreement No 864276).